The Significance of Taking care of Visa Obligation

How about we put this in genuine inflationary terms. On the off chance that you owed the previously mentioned normal of 5,733 of every 2022, your absolute interest installments would have been $1,003.

After one year, it Would be $1,330

That is $330 hard-procured dollars basically spent on nothing. Then there are the advantages of having a decent FICO rating.

Conveying a heavy month to month balance harms your credit on the grounds that 30% of your FICO rating depends using a credit card use. In a perfect world, you won’t pile up charges of over 30% of your credit.

Along these lines, assuming your all out credit limit is $10,000, your absolute surplus shouldn’t surpass $3,000. Assuming it’s higher than 30%, it shows to potential moneylenders that you’re experiencing difficulty dealing with your monetary obligations. You’ll risk being turned down for a credit or paying higher loan costs on the off chance that you truly do get one.

All in all, how would you expand your FICO assessment? Taking care of your bills on time and bringing down your obligation trouble are the two major ones, and there are different subtle strategies that merit investigating too.

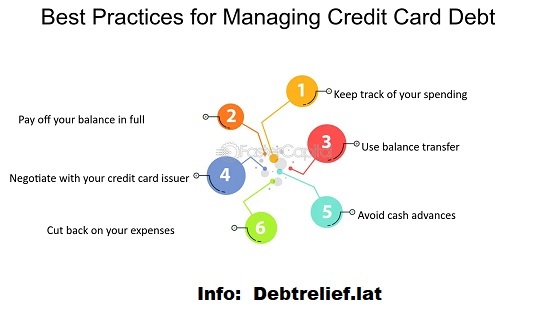

6 Tips To Manage and Pay Off Credit Card Debt

Taking out Visa obligation relies upon three things: ways of managing money, saving propensities and assurance. That last one will make the accompanying advances more sensible.

1. Keep on covering Your Visa Bills on Time

Paying on time implies no late expenses and different charges. Paying the whole equilibrium on time implies you will not be socked with extravagant interest charges.

The fine print in your Visa understanding provides the backer with a ton of ammo to make your life hopeless in the event that you’re late on an installment. That will ultimately appear on your credit reports at the three significant credit authorities (TransAmerica, Equifax and Experian).

2. Practice Mindful Spending

Figure out how to live inside your means and search for ways of cutting your costs.

Use credit admirably: In the event that you’re pondering charging something you can’t take care of in 90 days, reconsider.

Foster a reasonable financial plan and stick to it: Record your month to month pay and costs, then, at that point, track your spending.

Keep away from drive purchasing: Adhere to your shopping list. Leave your Visa at home and convey just how much money you’ve planned for your shopping trip.

Fix your luxuries: Make espresso at home and avoid that $5.29 Fair Coffee Cook at Starbucks. Try not to let magazine covers, popup advertisements, shop windows or Kardashians trigger your design spending motivation.

Inspect your bills: Check whether you can scale back link, web, and streaming stages. Audit your insurance contracts for potential reserve funds.

Search for basic food item bargains: Sit tight for deals and use coupons. Consider purchasing more affordable store brands. They’re frequently basically as great as the name-brand items.

Deal with your assets: Appropriate upkeep broadens the existence of things you depend on and assists you with keeping away from large dollar fix bills.

3. Pick a Mastercard Installment System

In the event that you’re significant about taking care of Visas, it implies making more than the base regularly scheduled installment. There are three demonstrated strategies to do that.

Obligation Snowball: This includes taking care of the card with the most minimal financing cost first. That inspires you to pay off the following most reduced, then the following, and it snowballs until you’ve taken care of all your obligation.

Obligation Torrential slide: This is the contrary methodology. Assault the card with the most elevated loan fee first. Work down from that point. It checks out than the snowball, yet it misses the mark on fast delight that a few buyers need.

Robotizing Your Installments: It’s a straightforward method for remaining current on your bills, in this way staying away from late charges, punishment interest and terrible reports to credit screens. Simply keep a nearby watch on your bank balance. Overdraft expenses can be more terrible than late punishments.

4. Ensure You Have a Rainy day account

Life occurs. Individuals get laid off, vehicles stall, kids need lines, the cooling unit goes acting up. They aren’t normal costs, however unforeseen bills generally appear to continuously spring up.

To be ready, attempt to assemble a rainy day account. Preferably, it ought to approach a half year of costs, on the off chance that you think of yourself as unemployed. That will hold you back from smacking down that cost on your charge card.

5. Pay More Than Your Base Installment

Visa organizations love it when clients pay the least sum expected to stay away from late expenses. It scarcely diminishes the general equilibrium and the interest charge. You’ll help yourself out by paying however much you can consistently.

A decent methodology is to target explicit buys on your bill. Setting up camp hardware from Dick’s Outdoor supplies. The yard trimmer from Home Terminal. The Tracker Biden painting.

Anything that the thing, research shows buyers pay 15% more when they check their assertions and pick explicit buys to reimburse.

6. Merge or Move Your Mastercard Obligation

Think about moving all your exorbitant premium bills into one with a lower generally financing cost. Such obligation combination programs have assisted incalculable shoppers with vanquishing their obligation issues.

Solidifying with a low-premium individual credit from a bank, credit association or tenable shared source will bring down your general bill and assist you with dealing with various charge card installments.

You could likewise exploit balance-move cards. Get a Mastercard with an incredibly low (most likely zero) early on rate, then move the equilibriums from your different cards to the upgraded one.

However, know, there’s normally an exchange charge of something like 3%. Also, take care of off the bill before the early on rate lapses (typically 12 – year and a half), or you’ll get pounded by the swelled standard rate.

Instructions

Work With Loan bosses to Lower Your Financing Cost

Does the accompanying depict you?

You’re deep rooted with your charge card issuer(s).

Your installments are generally on time.

You don’t go over your credit limit.

Assuming all that is valid, contact your card backers and request that they bring down your loan fees. They could very well.

Increment Your Pay

Sherlock says the more cash you make, the more cash you’ll need to take care of your obligations. There are a lot of side positions that will evoke more money.

- Find a second line of work.

- Request a raise.

- Require on additional hours at work.

- Search for impermanent or random temp jobs (jack of all trades, looking after children, work) on

- work sheets.

- Sell individual assets you never again use or need.

- Make a side business out of something you’re great at.

- Charge card Terms to Be aware

- Assuming you will dominate your Visa obligation, you want to comprehend Mastercard language.

- Here is the language.

Yearly Expense: Guarantors charge a yearly expense for the honor of utilizing their cards. It’s occasionally called a “enrollment” or “cooperation” expense.

Yearly Rate (APR): The yearly loan fee, including expenses and charges paid to make the advance. The estimation approaches the intermittent rate duplicated by the quantity of charging periods. Separate APRs might be displayed for balance moves, loans and other extra offers.

Normal Everyday Equilibrium: Determined by adding every day’s equilibrium and separating it by the complete number of days in the charging cycle. The outcome is increased by the card’s month to month rate.

Balance Move: Moving a neglected equilibrium starting with one charge card then onto the next.

Credit Cutoff: The most extreme sum you’re permitted to acquire on your card. A few backers block abundance charges, while others charge over-the-limit expenses.

Finance Charge: The charge for utilizing a Visa and conveying an equilibrium.

Beauty Period: The without interest period permitted between the date of the buy and the charging date for zero-interest cardholders. Not all card backers offer it.

Late Expense: The expense charged for missed installments. Least Installment: The littlest sum you should pay on time, normally 2% of the absolute equilibrium. Over-Cutoff Expense: The expense charged for surpassing your spending limit.