Introduction of Debt Management Plan

Welcome to our comprehensive guide on understanding the benefits of debt management plans. In this article, we will explore the various advantages that debt management plans offer to individuals struggling with debt. Whether you are overwhelmed by credit card bills, medical expenses, or other forms of debt, a debt management plan can provide you with the tools and resources necessary to regain control of your finances.

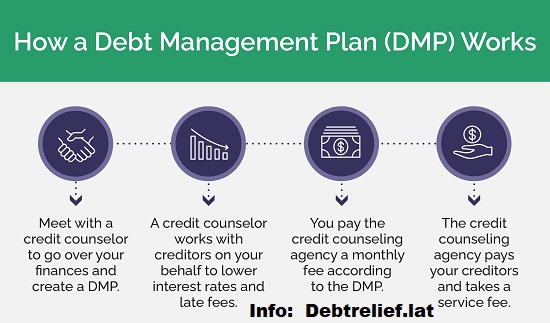

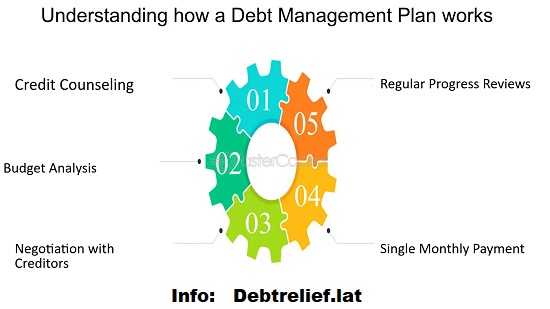

Before diving into the benefits, let’s first understand what a Bebt Management Plan entails. A debt management plan is a systematic approach to repaying your debts in a structured manner. It is a program that is designed to assist individuals in managing their debt by negotiating with creditors to reduce interest rates, waive fees, and establish affordable monthly payment arrangements.

By enrolling in a debt management plan, you work with a credit counseling agency that acts as an intermediary between you and your creditors. The agency’s role is to negotiate on your behalf, create a repayment plan, and distribute the funds you contribute each month to your creditors.

The Benefits of Debt Management Plans

1. Reduced Monthly Payments

One of the most significant benefits of a debt management plan is the ability to reduce your monthly payments. Through negotiations with your creditors, the credit counseling agency can often secure lower interest rates and eliminate or reduce late fees and penalties. This results in a more affordable monthly payment that is within your means.

2. Single Monthly Payment

Debt management plans simplify your financial responsibilities by consolidating multiple debts into a single monthly payment. Rather than juggling multiple due dates and payment amounts, you make one payment to the credit counseling agency, who then distributes the funds to your creditors on your behalf. This significantly reduces the administrative burden and makes it easier to stay organized.

3. Interest Rate Reduction

The credit counseling agency negotiates with your creditors to lower the interest rates on your debts. This reduction can save you a significant amount of money over time, as less of your payment goes towards accrued interest and more goes towards paying down the principal balance. With lower interest rates, you can pay off your debts faster and become debt-free sooner.

4. Stop Collection Calls

Once you enroll in a debt management plan, the credit counseling agency notifies your creditors about your participation. This communication typically results in a halt to collection calls and collection activities. The agency acts as your representative, redirecting such calls to themselves, allowing you to regain a sense of peace and reduce stress.

5. Eliminate Late Fees and Penalties

By working with your creditors, the credit counseling agency may be able to secure waivers or reductions in late fees and penalties associated with your debts. This can save you a substantial amount of money and make it easier to stay on track with your repayment plan.

6. Financial Education and Budgeting Assistance

Beyond negotiating with your creditors and managing your monthly payments, credit counseling agencies also provide financial education and budgeting assistance. They offer guidance and resources to help you develop effective budgeting strategies, improve your financial literacy, and avoid falling into debt in the future. This comprehensive approach empowers you to take control of your finances and make better financial decisions.

7. Faster Debt Repayment

With lower interest rates, reduced or eliminated fees, and a structured repayment plan, debt management plans enable you to pay off your debts faster. By making consistent monthly payments and benefiting from the negotiations conducted by the credit counseling agency, you can accelerate your debt repayment timeline and achieve financial freedom sooner.

8. Credit Score Improvement

As you make regular payments and reduce your outstanding debt through a debt management plan, your credit score is likely to improve over time. This is because a debt management plan demonstrates your commitment to repaying your debts and establishes a positive payment history. While initially, there might be a small impact on your credit score, the long-term benefits of becoming debt-free and improving your creditworthiness far outweigh any short-term impact.

Guideline Debt Management Plans

Debt management plans provide individuals struggling with debt various benefits for regaining control of their finances. These plans offer a systematic approach to repayment, negotiating with creditors to reduce interest rates, waive fees, and establish manageable monthly payment arrangements. By enrolling in a debt management plan, individuals work with a credit counseling agency that acts as an intermediary, negotiating on their behalf and distributing funds to creditors. The benefits of debt management plans include reduced monthly payments, simplification of financial responsibilities through a single monthly payment, and interest rate reduction, allowing individuals to pay down their debts more efficiently. Additionally, participating in a debt management plan can stop collection calls and eliminate late fees and penalties. Credit counseling agencies also provide financial education and budgeting assistance to empower individuals to make better financial decisions and improve their credit score over time. Overall, debt management plans offer a comprehensive solution for individuals overwhelmed by debt to achieve financial freedom.

In Summary

Debt management plans offer numerous benefits to individuals struggling with debt. From reduced monthly payments and interest rate reductions to simplified finances and improved credit score, enrolling in a debt management plan can be a game-changer. In addition, the financial education and budgeting assistance provided by credit counseling agencies empower you to become financially literate and avoid future debt. If you are overwhelmed by debt and looking for a way to regain control of your finances, it is worth exploring the advantages of a debt management plan.

Can I Set up a Debt Management Plan if I Get Centrelink Payments?

If you receive Centrelink assistance, you may still qualify for a debt management plan. “Do you have money left over after meeting your everyday living expenses?” is the essential question. Most Centrelink recipients have enough money to meet their basic living needs before they contemplate repaying any debts. If this is you, we will most likely be unable to assist you; however, we can refer you to a financial adviser who can. Everyone’s situation is unique, so if you’re unsure, please call us and we’ll walk you through the possible alternatives in further detail. We can offer you with feedback.

Organize Your Debt Management Plan Immediately.

Are you ready to become debt-free? Let’s start a chat. Our staff specializes in financial management. We can walk you through the process, providing alternatives that you can manage and sustain. We spend a significant amount of time laying the groundwork for long-term financial management. This way, even when your debt is paid off, you’ll still be able to manage your finances confidently. Check out some of our success stories online, where we’ve helped average Australians get their money back on track.

How can Way Forward help?

Step 1: Contact our staff.

Step 2: We examine your problem and collaborate with you to provide a feasible solution.

Step 3: We negotiate with your creditors on your behalf.

Step 4: We create a reasonable plan and aggregate your repayments into a single recurring payment across your creditors.

Tel: 1300045502

L14, 333 Collins St, Melbourne