Welcome to the guide on how to apply for a personal loan at U.S. Bank. If you are in need of some extra financial support, a personal loan can be a great tool to help you meet your goals. U.S. Bank offers a range of personal loan options designed to fit different needs and preferences. In this guide, we will walk you through the process of applying for a personal loan at U.S. Bank, step by step. Whether you are looking to consolidate debt, pay for a home improvement project, or cover unexpected expenses, this guide will provide you with the information you need to get started.

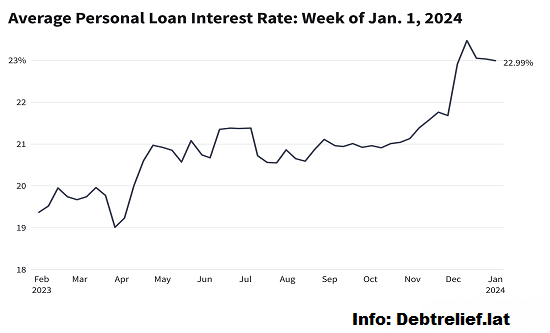

Before we jump into the application process, it is important to have a clear understanding of what a personal loan is and how it works. A personal loan is a type of loan that you can use for a variety of purposes. Unlike a mortgage or auto loan, personal loans are unsecured, which means they do not require collateral. This also means that personal loans usually have higher interest rates compared to secured loans. Personal loans are typically repaid in fixed monthly installments over a set period of time.

At U.S. Bank, you can apply for a personal loan ranging from $1,000 to $25,000, depending on your specific needs and financial circumstances. The interest rates and terms of the loan will depend on factors such as your credit score, income, and the amount you wish to borrow.

Gathering the Required Documents

Before starting the application process, it is important to gather all the necessary documents. This will help speed up the process and ensure that you have all the required information at hand. Here are some of the documents you may need:

- Proof of identification: This can be your driver’s license, passport, or any other government-issued ID.

- Social Security number: You will need to provide your Social Security number for identity verification.

- Proof of income: This includes pay stubs, tax returns, or any other documentation that shows your income.

- Bank statements: You may be required to provide bank statements to verify your financial stability.

- Proof of residence: This can be a utility bill, lease agreement, or any other document that shows your current address.

Make sure to have these documents ready before moving on to the next step.

Step 1: Research and Compare Loan Options

Before applying for a personal loan at U.S. Bank, it is important to research and compare the different loan options available. Take the time to understand the interest rates, fees, and repayment terms associated with each loan product. This will help you choose the loan that best fits your needs and budget. U.S. Bank offers a variety of personal loans, including debt consolidation loans, home improvement loans, and personal lines of credit. Make sure to explore all the options and choose the one that aligns with your financial goals.

Step 2: Visit the U.S. Bank Website

Once you have done your research and identified the loan product that suits your needs, it is time to visit the U.S. Bank website. On the homepage, navigate to the “Loans and Lines of Credit” section. From there, you will find a link to the personal loans page.

Step 3: Start the Application Process

On the personal loans page, you will find an option to start the application process. Click on the “Apply Now” button to get started.

Before proceeding with the application, U.S. Bank may require you to create an account if you don’t already have one. This will allow you to save your progress and come back to the application at a later time if needed.

Step 4: Fill Out the Application

Once you have started the application process, you will be required to provide personal and financial information. This includes your name, address, Social Security number, employment details, income, and the amount you wish to borrow. It is important to provide accurate and up-to-date information to avoid any delays or complications in the loan approval process.

U.S. Bank may also ask you to provide information about your existing debts and monthly expenses. This is to assess your overall financial situation and determine your ability to repay the loan.

Step 5: Review and Submit Your Application

After filling out the application, take the time to review all the information you have provided. Make sure everything is accurate and complete. Double-check your contact details and ensure that you have entered the correct information.

Once you are satisfied with your application, click on the “Submit” button to send it to U.S. Bank for review.

Step 6: Wait for Approval

After submitting your application, it will be reviewed by the U.S. Bank team. This process may take a few business days. U.S. Bank will assess your creditworthiness and financial stability to determine whether to approve or reject your loan application.

Step 7: Loan Approval and Funding

If your loan application is approved, U.S. Bank will notify you of the approval and provide you with the loan terms and conditions. Take the time to carefully review the terms and make sure you understand all the details before accepting the loan offer.

Once you have accepted the loan offer, the funds will be disbursed to you according to the agreed-upon method. This can be through direct deposit into your bank account or a check mailed to your address.

Step 8: Repayment

Once you have received the funds, it is important to make timely and regular monthly payments to repay the loan. U.S. Bank offers different options for making payments, including online payments, automatic deductions, and in-person payments at U.S. Bank branches.

Make sure to review the loan agreement to understand the repayment terms, including the interest rate, monthly payment amount, and the duration of the loan. Mark your payment due dates on your calendar to ensure that you never miss a payment.

Exposures

Reference 1

Individual advance: As of February 12, 2024 the proper Yearly Rate (APR) went from 8.74% APR to 24.99% APR, and changes in light of FICO rating, credit sum, reason and term. Least credit sum is $1,000 and advance terms range from 12 to 84 months (as long as 60 months for non-clients). The least APR in the reach is accessible on advances of $10,000 or more with a term of 12 three years, a FICO rating of 800 or more prominent, motivation behind home improvement and incorporates markdown for programmed installments from a U.S. Bank or outside private checking or investment account. Programmed installments and U.S. Bank individual checking or investment account are not needed for advance endorsement. Electronic subsidizing to a non-U.S. Financial balance requires confirmation and can take one to four work days. Not all advance projects are accessible in all states. The Purchaser Evaluating Data divulgence records charges, terms, and conditions that apply to U.S. Bank individual checking and investment accounts. This exposure can be gotten by visiting a U.S. Bank office or calling 800-872-2657. Advance installment model: on a $10,000 credit for quite a long time, regularly scheduled installments would be $316.79 and APR of 8.74% with programmed installments from an individual checking or bank account and with the end goal of home improvement. Most extreme advance sums might shift by FICO assessment. Advance endorsement is liable to credit endorsement and program rules. Loan costs and program terms are dependent on future developments without notice.

Conclusion

Congratulations! You have reached the end of the guide on how to apply for a personal loan at U.S. Bank. By following the steps outlined in this guide, you can navigate the application process with confidence. Remember to research and compare loan options, gather the necessary documents, and provide accurate information on your application. If your application is approved, make sure to review the loan terms and repay the loan as agreed upon. If you have any questions or need further assistance, feel free to contact U.S. Bank’s customer service for guidance. Best of luck with your loan application!

Contact Info:

U.S. Bank

800 Nicollet Mall

Minneapolis, MN 55402

Tel: +18884940017