Welcome to this comprehensive guide on securing business loans in the UK. Whether you are a seasoned entrepreneur or just starting your journey in the business world, obtaining the necessary funding for your ventures can be a crucial step towards success. This guide aims to provide you with valuable insights, tips, and strategies to help you navigate the process of securing business loans in the UK.

Understanding Business Loans

Before delving into the intricacies of securing business loans, it is important to have a clear understanding of what a business loan entails. A business loan is a financial product designed specifically for businesses and is typically used to finance various operational or expansion needs. It provides entrepreneurs with access to capital, which can be utilized for purposes such as purchasing inventory, investing in equipment, hiring staff, or even acquiring other businesses.

It is important to note that business loans differ from personal loans, as they are tailored specifically to meet the financial needs of businesses. Various lenders, including banks, credit unions, and alternative lenders, offer business loans in the UK. The terms and conditions, interest rates, and eligibility criteria of business loans may vary depending on the lender and the specific loan product.

Assessing Your Funding Needs

Before embarking on the loan application process, it is crucial to assess your funding needs and determine the specific amount required to meet your business objectives. This assessment will help you identify the purpose of the loan, the ideal loan amount, and the potential repayment terms that align with your business’s financial capabilities.

Researching Different Loan Options

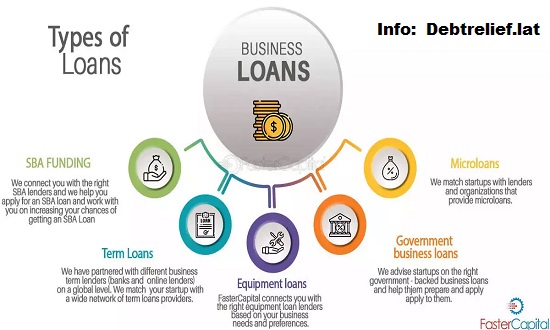

Once you have a clear understanding of your funding needs, it is essential to conduct thorough research on the different loan options available in the UK market. Familiarize yourself with the various types of business loans, such as term loans, lines of credit, equipment financing, and invoice financing.

Each loan type has its own features, advantages, and considerations. For instance, term loans are suitable for businesses seeking a lump sum of capital with fixed repayment terms, whereas lines of credit provide businesses with flexibility in borrowing and repayment. By researching and understanding the different loan options, you can make an informed decision that suits your specific requirements.

Choosing the Right Lender

Choosing the right lender is a crucial step in securing a business loan in the UK. It is essential to evaluate the credibility, reputation, and terms of different lenders to ensure a seamless borrowing experience. Consider factors such as interest rates, repayment terms, loan processing time, and any additional fees or charges associated with the loan.

Banks are a popular choice for obtaining business loans, as they offer competitive interest rates and a wide array of loan products. However, alternative lenders, such as online lenders and peer-to-peer lending platforms, have gained traction in recent years due to their flexibility and faster loan approval processes. Assess your business’s unique needs and preferences to determine the most suitable lender for your loan requirements.

Preparing a Solid Business Plan

A comprehensive business plan plays a crucial role in securing a business loan. Lenders often require a well-structured business plan that outlines your company’s mission, target market, competition analysis, financial projections, and repayment strategies. This document provides lenders with an insight into your business’s potential for success and helps them assess the level of risk associated with lending to your company.

When preparing your business plan, ensure clarity, conciseness, and accuracy. Incorporate your market research, competitive advantages, and growth strategies to showcase the viability of your business. Seek professional assistance, if necessary, to create a compelling business plan that enhances your chances of loan approval.

Gathering the Required Documentation

To streamline the loan application process, it is essential to gather all the necessary documentation before approaching lenders. The specific documentation requirements may vary depending on the lender and the type of loan you are applying for. Some common documents required for business loan applications include:

- Business financial statements

- Tax returns

- Bank statements

- Proof of business ownership

- Legal documents (e.g., licenses, permits)

- Business plan

- Financial projections

Ensure that all your documents are up to date, accurate, and organized. This will not only streamline the application process but also create a positive impression on lenders, increasing your chances of loan approval.

Building a Strong Credit Profile

A strong credit profile is vital when applying for a business loan in the UK. Lenders assess the creditworthiness of your business by reviewing your credit history, credit scores, and payment patterns. Maintaining a good credit profile demonstrates your ability to manage debt responsibly and increases your chances of securing favorable loan terms.

Regularly monitor your credit reports and address any errors or discrepancies promptly. Make timely payments on existing debts and avoid excessive credit utilization. Taking steps to improve your credit profile before applying for a business loan can significantly enhance your chances of loan approval.

Negotiating Loan Terms

Once you have received loan offers from potential lenders, it is essential to carefully review and analyze the terms and conditions. Compare the interest rates, repayment periods, and any other associated fees or charges.

Don’t be afraid to negotiate with lenders to secure more favorable terms. While some lenders may not be open to negotiation, others may be willing to adjust certain aspects of the loan to suit your business’s needs. Keep in mind that negotiation skills are crucial in obtaining the most advantageous loan terms.

Repaying Your Loan

Securing a business loan is just the first step; repaying it is equally important. Make sure to understand the repayment schedule and adhere to it diligently. Timely repayments not only help you avoid penalties and additional charges but also contribute to building a positive credit history.

If your business faces challenges in meeting repayment obligations, communicate with the lender proactively. Many lenders are willing to work with borrowers to find suitable solutions, such as loan restructurings or temporary payment modifications. Maintaining open and transparent communication with your lender will help alleviate financial stress and protect your business’s long-term interests.

Options

Securing a business loan in the UK can be a critical step towards fueling growth and achieving your entrepreneurial goals. By understanding the loan application process, researching loan options, and preparing diligently, you can enhance your chances of obtaining the necessary funding. Remember to assess your funding needs, choose the right lender, and negotiate favorable terms to create a solid foundation for your business’s financial success.

While this guide provides valuable insights and tips, it is always advisable to seek professional advice and guidance when navigating the complex world of business loans in the UK. Good luck on your journey to securing the funding your business needs!