Building a Decent FICO Rating

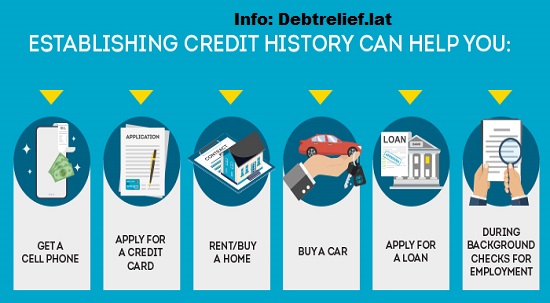

Each monetary choice you have may effect your FICO rating and your capacity to find a new line of work, credit, Mastercards, essential utilities, and administrations, in any event, leasing a loft or renting a vehicle. Great monetary decisions assist banks and organizations with considering you to be okay. You’ll be bound to get monetary open doors, including higher credit cutoff points and lower loan fees.

Financial assessments change. On the off chance that you’ve never had credit or committed monetary errors, savvy choices and capable activities, after some time, will prompt a positive credit report and monetary advantages.

Is it true or not that you are considering how to lay out credit that will further develop your financial assessment and report? Here are a few hints:

Fabricate Record of Loan Repayment that Benefits you:

Begin early

The length of your record as a consumer is a vital consider deciding your FICO rating

Begin little

Banks expect you don’t want to live inside your means when you apply for a ton of credit in a brief timeframe

Open Store charge card or Visas to Construct Credit

Cover your equilibrium every month or keep your equilibrium low. In the event that you don’t fit the bill for a store charge card or Mastercard:

Open a got charge card. It might permit you to utilize your cash to lay out a record of loan repayment. ( For instance, you contribute $300 to the card; your credit limit is $300.) Prior to opening a got Mastercard, affirm your installment history will be accounted for to the significant credit detailing organizations and consider charges, loan fees and the results of default1

Have Somebody Cosign your record or Portion Credit

Ask a relative or companion about turning into an approved client on one of their records. Credit movement on the common record might be accounted for in the essential cardholder’s name and might be accounted for in the approved client’s name. Check with the backer to affirm whether they report approved clients to credit authorities. Use alert. Unfortunate choices might influence both you and the essential record holder, as well as the other way around

Try not to Mishandle the Honor

Getting in a tight spot is simple. Pursue mindful choices with your charge cards and advances

Cover bills on time

Every single neglected bill, including charge card, clinical, cell, and so on., will show up on your credit report and adversely influence your score

The Most Effective Method to Reconstruct your Financial Assessment:

Audit your Credit Report

Routinely audit for unapproved movement, blunders and neglected bills. You might demand a free duplicate of your credit report every year at http://www.annualcreditreport.com.* Report issues right away

Make an Arrangement

- Foster a time period and make a financial plan for taking care of current obligations

- Contact all banks. If conceivable, set up installment plans

- Take care of delinquent records first, then obligations with higher loan costs; you might set aside cash

- Consider an obligation combination credit or equilibrium moves to a lower rate credit card2

Dealing with your obligation might permit you to take care of obligations sooner

Research Working with a Credit Guiding Organization

Search for the best administrations, expenses and plans. Be certain an office is genuine prior to giving individual or monetary data

Take Care of Bills on Time

Taking into account pursuing bill pay with your bank. Bill pay makes it simple to get and cover your bills, plan installments, and set up updates. Inevitably, it will emphatically affect your financial assessment and reliability

Use Alert while Shutting Accounts

It might adversely influence your FICO assessment by shortening your record as a consumer or diminishing your accessible credit

Plan for significant buys

High financial assessments might give borrowers lower loan fees and higher credit limits. It requires investment to further develop your FICO rating, so prepare when you plan to buy a home, vehicle or other first-class thing

The Most Effective Method to keep up with your Great Credit

Limit your records

Various store or potentially charge card records might bring down your FICO rating regardless of whether records are not utilized and balances are settled completely

Try not to Close old Records

Bringing down your accessible credit might bring down your FICO assessment

Utilize your Records

Make buys and pay the full equilibrium every month

Keep a Low Equilibrium To-restrict Proportion

Utilizing less of your accessible credit might assist with raising your FICO rating

Cover Bills on Time

Moneylenders consider installment records to assist with deciding your dependability

Keep up with work as well as main living place for at least 2 years

Moneylenders utilize this data to assist with deciding your solidness

Audit your Credit Report

Routinely audit for unapproved action and blunders. Report issues right away

Significant Exposures

This article is for general enlightening purposes as it were. It isn’t expected to give explicit monetary, speculation, charge, lawful, bookkeeping, or other guidance and ought not be acted or depended upon without the counsel of an expert consultant. An expert counselor will suggest activity in view of your own conditions and the latest data that anyone could hope to find.

*By tapping on this connection you are leaving our site and entering an outsider site over which we have no control.

Neither TD Bank US Holding Organization, nor its auxiliaries or members, is answerable for the substance of outsider destinations hyper-connected from this page, nor do they ensure or embrace the data, proposals, items or administrations presented on outsider locales.

Outsider locales might have different Protection and Security arrangements than TD Bank US Holding Organization. You ought to audit the Protection and Security arrangements of any outsider site before you give individual or private data.

How are Financial Assessments Determined?

FICO assessments are determined by seeing five key elements. Here are the key variables FICO considers.

- Installment history (35%): Whether you’ve paid past credit accounts on time

- Sums owed (30%): The aggregate sum of credit and advances you’re utilizing contrasted with your all out acknowledge limit, otherwise called your use rate

- Length of record (15%): The timeframe you’ve had credit

- New credit (10%): How frequently you apply for and open new records

- Credit blend (10%): The assortment of credit items you have, including charge cards, portion advances, finance organization accounts, contract advances, et

Take care of bills on time and in full “Making installments on time and keeping your equilibriums low are the two most significant variables with regards to building credit,” Griffin says.

Truth be told, installment history is the main variable making up your financial assessment. Your FICO rating thinks about whether you make installments on time or late and on the off chance that you convey an equilibrium month to month or cover it off.

It’s smart to cover off your bill in full every month to stay away from potential late installment expenses, punishment APRs and interest charges that frequently come about because of conveying an equilibrium. ( Realize when a charge card installment is viewed as late.)

“Before you open a credit account, you ought to realize the reason why you’re opening the record, why you will utilize it and how you will take care of the equilibrium,” Griffin says.

As a guideline, set up autopay for essentially the base installment, so you can keep away from superfluous disasters. You can likewise plan email, text or message pop-ups through your card guarantor

Keep a Low Usage Rate

“Assuming that your equilibriums increment over the long haul, your FICO assessments will endure. Your usage rate, or equilibrium to-restrict proportion, is the second most significant consider scores, behind your installment history,” Griffin makes sense of.

To ascertain your usage rate, include the absolute adjusts on the entirety of your Mastercards and partition by the complete of your credit limit across all cards.

Suppose you have two Charge Cards:

- Card A: $1,000 total and $3,000 credit limit

- Card B: $3,000 surplus and $5,000 credit limit

- Your all out surplus would be $4,000 and complete credit limit $8,000. That makes your use half, which is high. You ought to hold back nothing use rate around 30% to further develop your FICO assessment.

“Buyers must recollect, the lower your usage rate, the better,” Griffin says. ” While any equilibrium can make scores decline, use more prominent than 30% can make scores decline all the more quickly due to a lot more noteworthy possibility of default.”

In the event that you find it hard to monitor the level of credit you use, exploit different cautions card guarantors set, for example, when your equilibrium surpasses a specific sum or while you’re moving toward your credit limit. Assuming you have no issue covering your equilibrium every month, you can likewise call your card guarantor and request that they increment your credit limit.